India's Tata Motors highlights importance of comparing accounting standards when comparing companies.

Tata accounts for research and development costs differently than peers in a way which boosts profit in the near term. If comparing P/E ratios, this actually makes Tata more expensive than initially appears.

Tata's R&D program, at 6% of sales, is higher than 4%-5% global car makers typically spend on new products and designs.

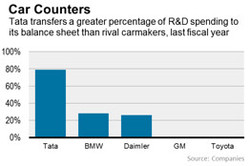

Tata capitalized roughly 80% of R&D activity fiscal year 2012/13.

Indian SUV-maker Mahindra & Mahindra capitalized 44% of R&D.

American and Japanese car makers expense all R&D spending, as local accounting rules require.

German auto makers, who report under international accounting standards, can capitalize R&D, though this has averaged only a third at BMW last 5 years.

Tata may need more R&D than BMW and Mahindra.

Tata says has followed this practice for years, meaning it isn't changing course.

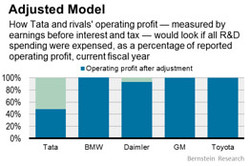

Net effect of Tata's R&D accounting is to bolster the bottom line. If all R&D spending were expensed, Tata's net profit would fall by 2/3rds, estimates Bernstein Research. Damlier's earnings would decreases by -10%. BMW's earnings would be boosted +1% since it amortizes older R&D spending and bears expense on income statement.

Adjusting for R&D this way, Tata's P/E valuation ratio increases from 9.6x to 28x earnings. Valuations at Daimler and BMW come in at 11.3x and 10.1x, after the same adjustments.

Source: http://online.wsj.com/news/articles/SB10001424052702303789604579199210852043816

CKB Solutions is all about real solutions for the real world. To learn how we can help your business, contact Greg Kovacic in Hong Kong.

RSS Feed

RSS Feed