- Perpetual bonds have no formal maturity and pay interest until the bond is bought back by the issuer

- Caveat Emptor: Perpetual bonds are much riskier than the name implies

What are Perpetual Bonds?

Perpetual bonds are bonds issued which pay an interest rate (usually annually) with no formal maturity and the issuer will usually have a call option to buy back the bond under specific circumstances. A perpetual bond can theoretically last forever, with investors never being repaid their principal but instead forever collecting an interest payment.

What are the Risks of Perpetual Bonds?

Perpetual bonds are much riskier than the name "perpetual" implies.

- Seniority: Perpetual bond debt can be subordinate to other company debt. This means perpetual bond investors are at the back of the creditor line behind all the other debt holders if a perpetual bond issuer defaults. An investor should make sure they understand whether their perpetual bond is senior or subordinate debt.

- Interest Rates: Perpetual bonds are very sensitive to interest rate movements since the cash flows are far in the future. When interest rates rise, their attractiveness falls since it is paying an interest rate less than an investor could currently get. This means the perpetual bond price falls to a price which matched the current available yield.

- Interest Rate Reset: This feature means the interest coupon rate will be adjusted periodically as interest rates rise after the initial interest coupon rate. f this feature is part the perpetual bond, keep in mind the interest rate does not normally reset regularly, but rather once every few years, sometimes once every 5 years.

- Interest Rate Step-Up: This feature means the interest coupon rate will be adjusted for interest rate increases, and by an extra set percentage (called step-up margin) on top of adjustments for interest rate increases as interest rates rise after the initial interest coupon rate. If this feature is part the perpetual bond, keep in mind the interest rate does not normally reset regularly, but rather once every few years, sometimes after 10 years.

If Institutional Investors Will Not Touch Them, Whey Should You?

Institutional investors normally avoid buy perpetual bonds because the risks are too high compared to the interest they pay. When institutional investors are not buying, bank push perpetual bonds on their private bank clients to buy.

"Perpetual bonds are favored by individual investors, some of whom are thirsty for yields and focus on short-term investments. Managers of large bond funds usually shun the instruments because perpetual bondholders rank low in a company’s capital structure and would be the last to recover their capital if the issuer defaults."

When will an Issuer Buy Back a Perpetual Bond?

The interest rate reset and step up may create an incentive for the issuer to buy back their perpetual bonds, because as interest rates rise, there becomes a point when interest rate payments become too expensive for the issuer to continue and will refinance. Investors in perpetual bond issuers will then get their principal back.

If a perpetual bond has no interest rate reset or step-up features, or the interest coupon rate increases are not enough to incentivize an issuer to buy back the perpetual bond, turn and run away from it as fast as you can. Investors will probably be left holding a long-maturity bond which declines significantly in value when interest rates rise.

Sources:

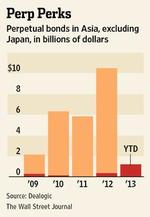

- "Perpetual Bonds", South China Morning Post, February 25, 2013.

http://www.scmp.com/business/money/markets-investing/article/1156330/perpetual-bonds - "Investors Get a ‘Perpetual’ Headache", The Wall Street Journal, January 21, 2013.

http://blogs.wsj.com/deals/2013/01/21/investors-get-a-perpetual-headache/

CKB Solutions is all about real solutions for the real world. To learn how we can help your business, contact Greg Kovacic in Hong Kong.

RSS Feed

RSS Feed