This risk is magnified in China because such guarantee chains have played large role in driving it's rapid massive debt expansion since the 2008 financial crisis. About 25% of US$13trn in total outstanding loans as of end of October 2014 was backed by promises from other companies and individuals to pay up if borrower defaults.

Lenders outside traditional banking system, aka shadow bankers, have also relied heavily on guarantees to assure investors their funds were secure and to circumvent government restrictions on lending to certain types of businesses.

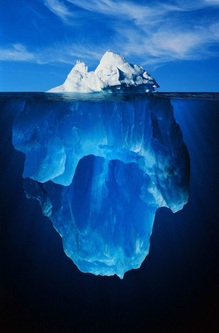

As typically happens when things start to slow down or go bad, what was once considered isolated, separate, and secure, turns out to really be closely linked and threatens broader/deeper risk.

Guarantees were traditionally used by state firms to back loans to undercapitalized units, Recently, they have been directed to unrelated companies. US$20.6bn of guarantees have been extended by companies listed in Shenzhen and Shanghai to firms other than their own units over the last 2 years (+76% increase), according to data provider Wind Information.

Guarantees play a key role in many countries where governments leverage their own balance sheets to encourage lending to small firms or to support home ownership. In US, Fannie Mae andFreddie Mac guarantee trillions of dollars’ worth of mortgages. Credit default swaps are used by private-sector lenders to insure themselves against risk of borrower defaulting.

China is, as always, different. In China, individual companies are the guarantor.

Such guarantees gave banks false sense of security and they did not scrutinize borrowers’ ability to pay, some analysts and banking executives say.

Customers of companies forced into liquidation can also have their business negatively impacted as the debtor's assets, including machines and inventory are locked up awaiting liquidation. Production scheduled, becomes unscheduled.

Source: http://online.wsj.com/articles/loan-guarantee-chains-in-china-prove-flimsy-1416775097

CKB Solutions is all about real solutions for the real world. To learn how we can help your business, contact Greg Kovacic in Hong Kong.

RSS Feed

RSS Feed