Background

Between 2009 and 2013, Goldman Sachs helped Tesco execute a sale and leaseback plan which used 6 SPVs to issue around £4bn worth of property bonds. Analysts think the effect of this off-balance sheet financing has been to artificially reduce Tesco’s net debt by around £2bn.

Between 2009 and 2013, 6 SPVs — Tesco Property Finance 1 through 6 — issued around £3.6bn of 30 year bonds to investors. These SPVs are not Tesco subsidiaries, although Tesco is contractually obliged to cover interest and principal payments.

Structure

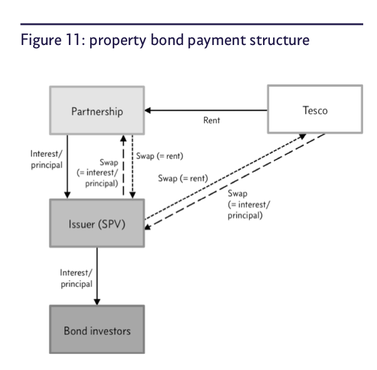

For each transaction, Tesco established limited partnership to which it sold package of properties, which it leased back for 30 years with annual rent increases linked to the retail price index (RPI).

Purchase was financed by issue of 30-year bonds by SPV, which loaned proceeds to partnership.

Bonds and partnership loan have identical, back- to-back terms, with same fixed interest rate and repayment schedules.

To solve cashflow mismatch between RPI-linked rents paid by Tesco to partnership, and fixed payments due on bonds, partnership and SPV, and SPV and Tesco entered into back-to-back swap arrangements. Netting off various swap and other payments, Tesco receives amounts equal to rental income and pays to SPV amounts equal to interest and principal repayments on bonds.

Rent payments are completely circular: Tesco pays rent out of one pocket to partnership and receives it back (via SPV) in another. In simple terms, Tesco receives bond proceeds and repays interest and principal; bond investors look to Tesco as source of all bond payments, while underlying property leases are, in effect, irrelevant.

These bonds don’t appear on Tesco’s balance sheet, being treated as regular operating leases instead. But even here, disclosure is limited. While leases have 30-year term, Tesco has break option after 10 years if it buys back the properties – so it only has to disclose minimum future lease payments up until that point. And because Tesco only has option to buy back properties — and is not required to do so — cost of buying back properties is not treated as an obligation either.

Tesco has choice between 2 obligations: (1) Buying back properties or (2) paying rent. Yet Tesco's off-balance sheet financing allowed it to avoid recording either obligation by saying both are options. There is only one true option, to recognize the lower of the 2 values at your liability exposure. Tesco failed this test.

From 2010, Tesco had regular wording buried in its annual report setting out the above — until this year, when it added: "

Current market value of these properties is £5.4bn (2013: £5.2bn) and total lease rentals, if they were to be incurred following option exercise date, would be £4.2bn (2013: £4.1bn) using current rent values.

Discounting £4.2bn back to present value increases Tesco’s total debt by £2bn.

How many times until leaders learn off-balance sheet financing is a paper allocation exercise which simply serves to mask the true transparent situation of the company. Rarely is it really off-balance in the send the liability does not belong to the company itself in the end.

Ultimately, when leadership of a company becomes more focused on managing numbers, they lose focus on managing to take care of customers. Result is a company in double whammy trouble: The business suffers as it loses touch with satisfying customer's needs who defect to competitors and the financial situation turns out to be worse than everyone saw on paper.

Sources:

http://ftalphaville.ft.com/2014/09/22/1979462/tescos-off-balance-sheet-wheeze-courtesy-of-goldman-sachs/

http://discount-investing.com/2014/08/26/tescos-hidden-debt/

CKB Solutions is all about real solutions for the real world. To learn how we can help your business, contact Greg Kovacic in Hong Kong.

RSS Feed

RSS Feed