- Competition from consumer-electronics with hand-held devices is changing the way children play in and between offline and online worlds

- Tough economic conditions are cutting discretionary spending

- Intense retailer competition (especially in the U.S.) and e-commerce is driving prices and value down

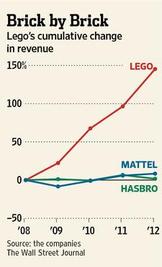

Not surprisingly, revenue growth of the overall U.S. toy market was flat in 2012 from 2011. What is surprising is the building block sector grew 20%. Lego's U.S. building-block market share is 85%.

Understandably, competitors are looking to enter Lego's domain and create and sell their own versions of construction building block toys.

- In 2011, Hasbro launched its Kre-O Transformers construction sets which are compatible with Lego

- In 2012, Mattel teamed up with Canada's Mega Brands to launch a line of Barbie construction toys, directly challenging Lego Friends and trying to reinvent the Barbie doll, which itself saw sales decline in 2012.

- In 2013, Hasbro plans to launch Kre-O G.I. Joe.

Will they be successful? Hasbro and Mattel have plenty of brands. But Lego is one of those rare iconic brands which defines an entire category. Think Xerox, Kleenex, Q-Tips, Band-Aids, Coke, Swiss Army Knife, FedEx, Ziploc, iPod, Skype, Google, etc., which enter common usage as either a verb or noun to describe all competitors.

For Lego, the block is core. For Hasbro and Mattel, the block is simply an extension of their main toy brands. Lego has history. Many generations have grown up playing with Legos, who then encourage their kids to play with Legos and so on in a virtuous cycle. Some kids who grew up playing with Legos remain customers of much high-priced collector edition sets, which is a big part of Legos turnaround over the last decade. Lego is the dominant product, with everyone else being looked at as a copycat. If you are invested in huge Lego sets, you do not want to play with blocks which are not compatible. Would Hasbro and Mattel not be better off entering licensing agreements with Lego so all the big brands can integrate into the Lego platform? Habsro and Mattel would sell more. Together, Lego, Hasbro and Mattel could create an even stronger incentive and attraction for kids to put the video games down. This is a good example of where instead of turning an indirect competitor into a direct competitor, cooperation would yield better results for all.

Source: "Lego Shrugs Off Toy-Market Blues", Wall Street Journal, February 21, 2013.

http://online.wsj.com/article/SB10001424127887323549204578317603729616028.html?mod=ITP_businessandfinance_3

CKB Solutions is all about real solutions for the real world. To learn how we can help your business, contact Greg Kovacic in Hong Kong.

RSS Feed

RSS Feed